Affording Cosmetic Surgery – Top 10 List of Payment Options

In the not so distant past, it was a common belief that plastic surgery was only for the rich and famous. Who else could possibly afford such an expensive luxury, right? Well things have drastically changed over the past decade and now plastic surgery is becoming almost as mainstream as tuning up your car. Ok, that wasn’t a great analogy, but you get the drift. Surprisingly, when the economy crashed in 2007/2008 something unexpected happened. The everyday person started finding creative ways to afford cosmetic procedures. Why, you ask? So many people lost their jobs and others feared they would soon be laid off. New jobs were tough to come by due to the large number of applicants employers had to choose from. It seemed as though the young go-getters were the first to be hired. This left the 40+ age group panicked. They quickly turned to cosmetic improvements to enhance their appearance, so they could look more youthful and refreshed in hopes of landing a job over the 20 and 30-year-olds.

In the not so distant past, it was a common belief that plastic surgery was only for the rich and famous. Who else could possibly afford such an expensive luxury, right? Well things have drastically changed over the past decade and now plastic surgery is becoming almost as mainstream as tuning up your car. Ok, that wasn’t a great analogy, but you get the drift. Surprisingly, when the economy crashed in 2007/2008 something unexpected happened. The everyday person started finding creative ways to afford cosmetic procedures. Why, you ask? So many people lost their jobs and others feared they would soon be laid off. New jobs were tough to come by due to the large number of applicants employers had to choose from. It seemed as though the young go-getters were the first to be hired. This left the 40+ age group panicked. They quickly turned to cosmetic improvements to enhance their appearance, so they could look more youthful and refreshed in hopes of landing a job over the 20 and 30-year-olds.

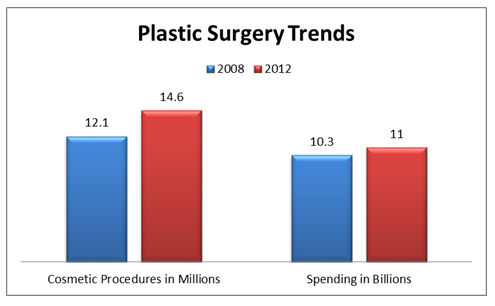

Increase In Cosmetic Procedures Between 2008 And 2012

As the trend shifted more towards the mainstream population having cosmetic procedures, both surgical and non-surgical, the statistical reports published by the American Society of Plastic Surgeons showed a substantial increase in the number of procedures performed between 2008 to 2012. Statistics showed in 2012 there were 14.6 million cosmetic procedures performed totaling $11 billion spent, compared to 12.1 million performed and $10.3 billion spent in 2008.

Even with the surge of people seeking out cosmetic improvements, there is still a large number of men and women who think it’s financially out of their reach. After all, the majority of procedures performed are considered elective and not covered by insurance. That means this is a 100% “out of pocket” expense. So how does the average American afford to have cosmetic enhancements? Take a look below at the Top 10 list of payment options Cruise Plastic Surgery has compiled. Your goal of having a cosmetic procedure might just be a reality sooner than you thought!

Top 10 Payment Options

- Cash – This is always a smart way to pay for purchases. If you don’t have the total amount readily available, set up a budget and put away a specified amount monthly until you have the entire amount saved up. Although cash is a great way to go, some people like to use a credit card that earns them miles or points and then pay off the bill when they receive it.

- Healthcare Credit Cards – These are typically only for elective healthcare treatments. Those offer quick approval time with payment terms, interest rates and credit limits which vary patient to patient. Two popular choices: Care Credit and Citi Health Card.

- Traditional Credit Cards – You can always use your own personal credit card or apply for a new credit card that has a 0% introductory rate so you save on interest. Another tip: Use a credit card that earns you miles or points. Very popular option for those who like the added perk of earning free or discounted travel, etc.

- Bank Loan – A personal loan from your primary bank or a credit union.

- Home Equity Loan or Line of Credit – If you own a home and have equity, you could explore taking out a line of credit. Interest rates are currently quite low making this a reasonable option.

- 401(K) (or other retirement or savings investment plan you might have) – Most accounts allow customers to borrow up to a certain amount of the vested balance. Repayments are often automatically deducted from your paycheck for a period of time. Check with your plan for specific information.

- Unsecured Medical Loans – These types of loans are typically brokered through a third party, sub-prime lender. This option is good for those who have a less than optimal credit score or history. Interest rates tend to be higher and payment terms not as flexible. Co-signers might be allowed as well. Med Loan Finance, My Medical Financing, My Medical Loan.

- In-House Payment Plans – Some offices will create a payment plan that works with a patient’s budget. Most will require the money to paid in full prior to having surgery. Think of this like a layaway plan for plastic surgery!

- Loans from Family or Friends – If you can’t come up with the money yourself, consider asking someone close to you for a loan. There is a great website that allows people to create loan agreements, payment plans, and tracks repayment. You can also create custom terms, such as monthly payment amount, length of loan, and whether interest will be charged or not. Visit: Lending Karma.

- Gifts – Why not ask for donations toward your procedure? Instead of receiving traditional gifts for your birthday or other holidays, ask people for money gifts or gift certificates to your doctor’s office. You can even set up funds on-line where people can easily donate. Check out: Smarty Pig and Deposit a Gift.

Schedule a Consultation

To learn more about your plastic surgery options, schedule a consultation with Dr. Cruise. Call our Newport Beach, CA office at (949) 446-1421 or contact us online. Out-of-town patients can also follow our fast-track online consultation process to find out if they are candidates for surgery with Dr. Cruise.